From purchase to refinance to construction lending, for a new home. The experienced loan professionals are dedicated to creating the perfect loan package for each client. These materials and information are not from or approved by HUD/FHA. Moneyhouse is a full-service mortgage banking company offering a diverse array of products for home loan needs. Not all programs will provide proceeds sufficient to pay off outstanding debts and liens filed of record. Programs and products noted may require the payment of upfront, annual and/or monthly private mortgage insurance premiums and/or mortgage insurance payments. For purchase transactions, property value is determined as the lesser of the final purchase price or the adjusted appraised value – refer to specific program qualification and eligibility guidelines offered by your professionally licensed Moneyhouse Mortgage Loan Originator for more details. 200km of road cycling routes, 181km of signposted mountain bike trails, cross-country, hiking paths, and one of the very best spas in town: Faern Crans-Montana welcomes you. For refinance programs, program imitations may include cash-out options and loan-to-value – refer to specific program guidelines offered by your professionally licensed Moneyhouse Mortgage Loan Originator for more details. Some programs referenced may require specific 3rd party or designated housing counseling requirements.

#MONEYHOUSE DER PROFESSIONAL#

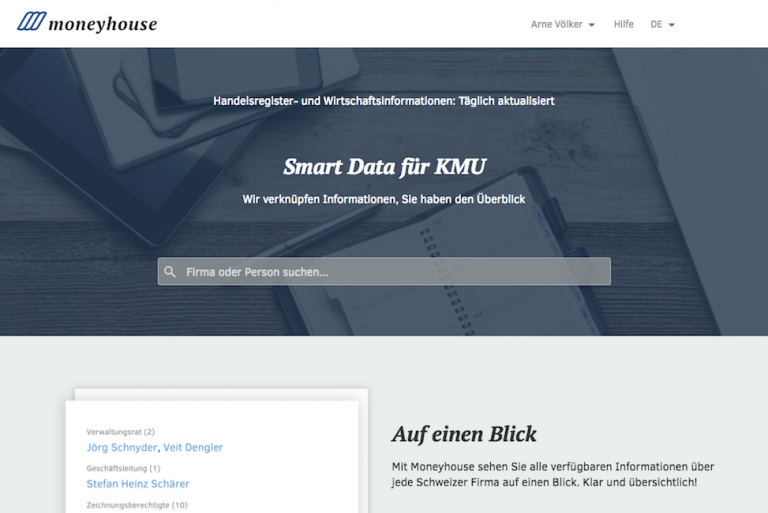

You are encouraged to seek professional services assistance for accounting, legal and real estate matters relating to your contemplated transaction. Individual and property specific program qualification guidelines including borrower and property eligibility should be discussed with a professionally licensed Moneyhouse Mortgage Loan Originator. This information is not a loan commitment, loan approval, or offer to lend. Terms, features and benefits for specific loan programs and information provided are subject to change without notice. Moneyhouse Deutschland AG is a company that operates in the Pharmaceuticals industry. Nutzen Sie die Suchbox oben auf dieser Seite, um gezielt nach Firmen oder Personen zu suchen. Not all programs, references, products, options and terms indicated are available in all states. Die kostenlose Onlinerecherche von North Data bietet die grte frei zugngliche Zusammenstellung von Gewinn- und Umsatzzahlen deutscher Firmen. Townhomes, Planned Unit Developments HUD approved condominiums and Single Unit Approval (SUA) condominiums permitted with review.Eligible property types of One to Four Family principal residences,.Unlimited Loan-To-Value availability for FHA Streamline Refinances.Loan-to-Value availability to 80.00% for cash out refinances.

Loan-to-Value availability to 97.75% for no cash out refinances.Loan-to-Value availability to 96.50% to Purchase a New Home.

#MONEYHOUSE DER FULL#

From live videos, to stories, to newsletters and more, LinkedIn is full of. Less stringent Borrower qualification requirements – greater income, employment and credit considerations Sending messages to people you know is a great way to strengthen relationships as you take the next step in your career.Low down payment options – as low as 3.5%.

#MONEYHOUSE DER HOW TO#

0 kommentar(er)

0 kommentar(er)